Threat of escalation makes investors nervous

Stock markets are tense and reacting nervously to the looming conflict between Ukraine and Russia. Indications of an easing of tensions and news of a threatened escalation alternate, causing ups and downs on the stock markets. In the past, cryptocurrencies were a popular alternative for investors to cushion the fluctuations on the trading floor, but BTC in particular has established itself and is reacting almost in line with the stock markets. Looking back a quarter, bitcoin is currently a third cheaper.

What does the future of bitcoin look like?

Crypto market analyst at Japanese bitcoin exchange Bitbank, Yuya Hasegawa, sees BTC currently involved in geopolitical tensions. “Bitcoin is referred to by some as a stateless currency and has actually performed well in the past during geopolitical tensions, so we could expect some safe haven demand,” CNBC quotes the expert as saying. However, the change in landscape has left bitcoin vulnerable to volatility in U.S. stock markets, Hasegawa adds. He sees an easing among BTC investors tied to a calming in the Russia-Ukraine border conflict.

Hasegawa’s view of a calming analogous to the geopolitical situation is not shared by Chris King, CEO and founder of Eaglebook Advisors. He doesn’t believe bitcoin weakness will end quickly. “If we are in a bear market, we will see another eight or nine months of sideways to downward movement, which is an opportunity for the crypto tourists to leave the market and for the real players to develop this technology,” the expert is quoted as saying by CNBC. He added that while there is new interest in DeFi, it is too early for it to take off and the concept is too underdeveloped. “Bitcoin was also hard to buy in 2013 to 2016, but companies like Coinbase and Gemini have made it easier,” he said. DeFi needs that ramp to improve and become less speculative. It just takes time,” King continued. What Bitcoin lacks is a low-threshold function that makes it indispensable – helpful in moving towards that is increasing adoption.

Bitcoin in the Ukraine conflict

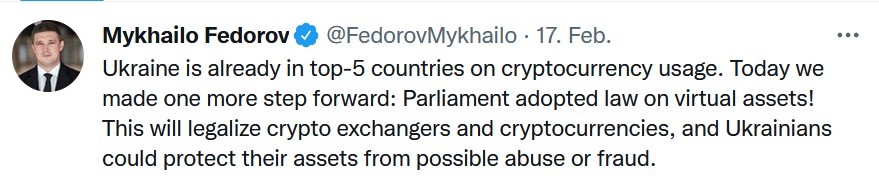

The crypto ban from China has led to migratory movements of miners. Ukraine has benefited massively by legalizing cryptocurrencies. Ukraine’s Deputy Prime Minister Mykhailo Fedorovon posted on Twitter that the Ukrainian parliament has passed a law on virtual assets that will legalize cryptocurrencies. This step also aims to protect Ukrainians’ assets from possible abuse or fraud, the politician said:

Screenshot: twitter.com

The threat of escalation in the dispute with Russia has certainly played its part in this decision, as cryptocurrencies are playing an increasingly important role in this conflict. “Wired” reports that crypto donations to the Ukrainian military have surged recently. Pro-Ukrainian hacktivists are also increasingly funding their digital resistance through cryptocurrencies, “Wired” adds. Bitcoin thus remains in the grip of geopolitical uncertainty, to which BTC investors are reacting cautiously. We are monitoring events closely and will keep you informed about ongoing developments.