Ecosignal for the crypto market

With the transition to the new consensus process, the blockchain will save almost the total amount of its current energy demand from 2022. A well-known and often used argument against the crypto market is its energy demand. At Everlast Fund, we have made energy consumption comparisons with countries for you: The Bitcoin network, for example, consumes the same amount of electricity as Sweden and pumps as much CO₂ into the air as New Zealand. Ethereum, on the other hand, currently requires 104 terawatt hours per year – which is roughly equivalent to Kazakhstan’s energy needs. Bulgaria, on the other hand, emits almost 50 megatonnes of CO₂. But that’s over now: Ethereum’s transition to Proof of Stake significantly curbs the energy demand.

Bye bye, PoW

Proof of work is becoming a discontinued model – like Bitcoin, it is the reason for the high energy demand. In this consensus process, miners bundle transactions into blocks, verify them and pin them to the blockchain. As a reward for the use of computing power, there is a reward of two Ether per block. Subsequently, increased hash power is used to try to increase the chances of finding a valid block.

The advantage of a high hash rate is that it protects the network from attacks, because rewriting the history of a blockchain or executing double spends would require more than half of the total computing power. And even though there used to be 51 per cent attacks, ETH and BTC are no longer worthwhile targets, as the computing power required would simply be too high in relation to the achievable loot.

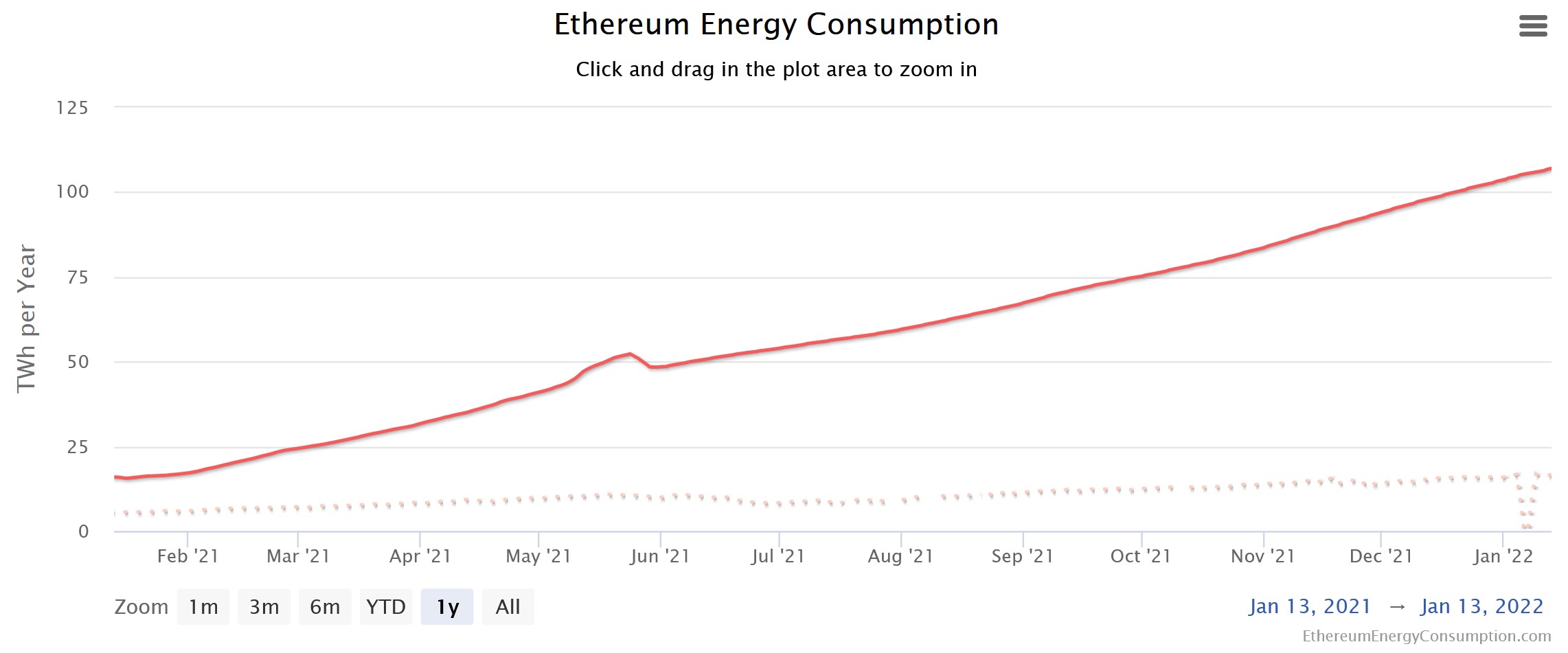

The disadvantage of a high hash rate, in turn, is that it leads to a global arms race with drastic effects on power consumption. The hunger for hardware leads to a shortage on the market, rising prices and ever-increasing energy demand: Digiconomist ranks Ethereum’s energy consumption at 15 terawatt hours (TWh) at the beginning of last year. By the end of December 2021, it will already be over 100 TWh:

The figures speak for themselves, and not only our experts at Everlast Fund, even developers, consider ETH’s current energy expenditure to be too high. There is no way to sugarcoat this: Energy consumption is getting out of hand. Fortunately, Proof of Work was never intended to be a permanent concept. It was only meant to bridge the time until the far more resource-efficient proof-of-stake procedure was tested and introduced. And 2022 is the time.

A question of consensus

In Q2 of this year, it should become reality that the current mainchain merges with the PoS- based beacon chain. After that, PoW will be a thing of the past for Ethereum – from then on, the network will secure itself with Stake (deposited Ether deposits) instead of computing power.

Validators, rather than miners and their computing power, will then be responsible for block production. This significantly reduces Ethereum’s energy consumption by 99.95 percent compared to now. In the future, the demand will be reduced to the operation of nodes, which will make the huge mining farms obsolete.

Quantum leap through sharding

Ethereum plans to use the scaling solution Sharding to increase transaction throughput by splitting it across parallel networks. This will allow the performance of currently 15 transactions per second (TPS) to be increased by a64 factor in the future. Shard Chains are planned to be deployed in 2023 to further support the future growth of the Layer 2 ecosystem, which should allow Ethereum to reach a throughput of 25,000 TPS WITHOUT scaling solutions such as Layer 2 rollups. Once implemented, Ethereum could reach a staggering 100,000 TPS!

But Layer 2 rollups play a crucial role not only for throughput. They execute transactions outside the Ethereum mainchain. If the scaling solutions also reduce the gas fees (transaction costs), we at Everlast Fund also see a clear migration towards Layer 2 rollups among users. Logically, they enjoy the advantages such as security and flexibility, but also benefit from low transaction fees. This means that the Ethereum base chain has had its day.

We look to a green future

Sustainability and resource conservation are not just buzzwords, but business drivers for global industries worth billions. The crypto market as a whole and Ethereum in particular are no exception: ETH, as the largest smart contract platform, forms a multi-layered ecosystem of decentralised applications. It and its many applications, from decentralised exchanges to NFT marketplaces, will undoubtedly benefit from improved energy efficiency. And we, as investors at Everlast Fund, are also already relying on ETH as an important component of their portfolios, and not without reason.